Any forecasting of business events is always difficult especially under the turbulent circumstances which we currently face. According to Niels Bohr [1], “Forecasting is more challenging when it comes to the future”. Analysts try to predict the shaping of the most important economic categories such as: Gross Domestic Product (PKB), the level of inflation, the rate of exchange of currencies and the level of interest rates. Any prediction for 2022 is burdened with a high degree of uncertainty because of the risk of unforeseeable events which might diversify all estimations of economists. 2022 will see an economic and financial transformation and witness a transition to a post-COVID -19 reality and to a world in which lower interest rates will be consigned to history [2]. This will lead to a reality driven by moderate profits on financial markets and we probably will not encounter any spectacular growth of different asset classes as was the case in the natural gas and coal market in 2021. Even more variable reading of economic indicators force the analysts to frequent verification of their assumptions and corrections of their predictions. As a result predictions made in the previous year have not been confirmed in particular with regard to inflation. Instead of the predicted 2.5% by the end of 2020, prices for consumer goods and services have increased on average by 5%. Due to this fact any forecasting for 2022 will be formulated by analysts with some caution. The participants of a New Year prediction survey by the newspaper “Rzeczypospolita” indicated that the Consumer Price Index (CPI) being the main inflation measure in Poland will grow to 7.1 % on average. The discrepancies between extreme predictions are rather large and amount to 2.5%. A part of participants predict that inflation will be 5.8% and the remaining at a level of 8.3 % (see diagram 1) [3].

Diagram 1 – Predictions for the Polish Economy in 2022. Source: Bloomberg, Rzeczpospolita, the prediction of over 20 teams of economists participating in the survey in the second half of December 2021 by the Bloomberg agency estimation of economists participating in the survey in the second half of December 2021 by Rzeczpospolita

PKB w cenach stałych w proc rok do roku means – GDP at basic prices as a percentage year on year

Inwestycje w proc. rok do roku means – Investments as a percentage year on year

Stopa bezrobocia rejestrowanego w proc. pod koniec roku means – the unemployment rate registered as a percentage by the end of the year

Inflacja CPL w proc. rok do roku, średnio w roku means – inflation as a percentage year on year, annual average

These differences reflect correctly the character of inflation. To a large extent it will depend on many unforeseeable factors. This encompasses commodity prices, especially prices of energy and agricultural materials, any disturbances within the global chain of deliveries caused by Covid–19 restrictions as well as government decisions about the mechanism of the so–called “Inflation shield [4].

The Polish government predicts that the inflation rate will be at the level of 3.3% (in accordance with the 2022 budget law). This action is caused by political promises. A 3 higher real inflation than the planned inflation (as per recent budget) will lead to higher budget revenues [5]. In addition, a higher inflation level will cause higher prices and will generate higher VAT taxes (included in the price of each product and services in Poland) resulting finally in higher proceeds of the state budget. Higher inflation also has an impact on higher wages and incomes of Poles and this will naturally correspond with higher social insurance contributions and higher income taxes (PIT). A hidden inflation and its effect on the state budget can be deemed a financial cushion which is not revealed within the budget law and it might be used to boast success and to fulfil state budget’ directives as in 2021 pursuant to Professor Witold Orłowski [6].

Analysts predict that inflation will force the NBP (Polish National Bank) to raise interest rates by up to 3.5% although there are also estimations according to which the rates will reach the 4% level. The extreme forecast indicates that the reference rate of the NBP will amount to 4.25% as it was at this level in 2012 for the last time. However, the raising of interest rates should increase the interest in Polish currency and limit its gradual depreciation which remained in effect for many months after the NBP weakened the Polish “Złoty” in December 2000 justifying it as support for Polish exporters [7]. This led to spiraling inflation as for instance fuels (energy and gas) are imported products [8].

The dynamic of the buying power of households will finally depend on the amount of inflation and the situation on the labor market. According to the major part of respondents by “Rzeczpospolita”, expenditures of households will realistically increase (constant prices) by 4.4% compared to 6% in 2021. All these calculations are based on the assumption that the Polish government will tighten monetary policy in order to avoid any further weakening of the labor market. We can thus expect the decreasing of consumption of households due to inflation and introduced changes to taxes in accordance with the so called “Polski Ład” (Polish order) that has been announced by the government as a means of steering Poland out of the economic crisis after the Covid–19 Pandemic and helping the major part of society. In December 2021 it turned out that the “Polski Ład” is full of flaws and can be summarized as follows: “The middle class will get back to zero and the wealthiest get profit anyway” [9].

Bank analysts [10] presume that in 2022 wage demands will rise with large increase in the prices of products and services of the first necessity. As a consequence the average pace of the increase of wages in the Polish economy will grow by 8.6% and temporarily it may exceed 10% per annum.

The forecast subject to investments seems to be optimistic. According to estimations of interviewed economists by the newspaper “Rzeczpospolita” gross fixed capital formations within the Polish economy will raise on average in 2022 by 7.2% compared to 7.6% in 2021. Conversely, bank analysts [11] expect that investments will be boosted by 11%.

This will happen as result of relocation of production (to Poland), of high use of generating capacity and a shortage of employees that will foster automatization of production and companies will seek less energy intensive technics of production. *In the second half of 2022 it is expected that National Recovery Plan will be implanted and public investments improve in size. Thus a lot will depend on public investments which will stimulate subsidies and loans from the EU budget (a new EU budget perspective for 2021 – 2027).

The conflict of the Polish government with the EU shall be deemed a special issue for Poland. Funds from the Recovery Fund shall be spent on very useful objectives as for instance renewable energy sources or digitalization. This program is under the strict supervision of the EU and therefore there is a lower risk that that these funds will be misspent by the government taking into account the interests of the ruling party and not the public interest. The growing conflict with the EU and anti-EU rhetoric from government’s side may accelerate the risk that Poland will be drifting towards Polexit which may cause long-term damage.

Economists predict that economic activity in Poland measured by real PKB (GDP) will increase on average in 2022 by 4.5% compared to between 5.4% and 5.5% in 2021. Some predict a rise of PKB by 5.2%. Other economists expect the PKB dynamic at the level of 3%. Bank analysts [12] think that the main factor affecting the amount of PKB in 2022 will be the course of the following waves of COVID–19 infections. According to them, recent data shows an increased immunity of the economy against the next waves of illnesses and less impact on social mobility. They assume according to their scenario that despite new waves of the Pandemic the generated immunity (due to vaccinations and immunization) will protect against a severe course of the infection. As a result, onerous lockdowns and the decrease of social mobility may be avoided and thus the scale of imposed limitations will not heavily disturb the economic activity.

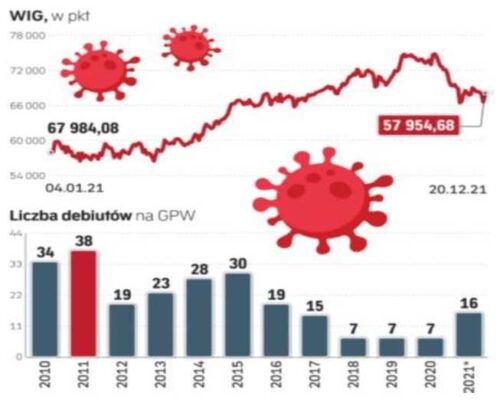

The current pandemic-related situation also affects the capital funding market. The prices of stocks of companies enlisted on the GPW (Stock Exchange Market) in Warsaw are a vital barometer of the economic trends in our country and reflect additional turbulences in the economy and often they are ahead of them. Despite pandemic related disruptions the WIG laid down a historical maximum extending the level of 75 thousand points (see diagram 2 below) and the GPW was the third-placed market in Europe with the biggest increase of trading stocks during the coronavirus Pandemic.

Liczba debiutów means – the number of new listings

The stock market was supported by the NBP providing after the Covid-19 outbreak a loose fiscal policy that was contributory to the increase of inflation causing a wave of the rise in interests rates. This will have an impact on the stock exchange market in 2022 [13] . According to analysts [14], the bearer market on GPW occurred shortly after the Polish government introduced a cycle of the increase of interests rates. This analogy suggests that in the coming months we can face an end of the upwards trend on the GPW. Pursuant to T. Bardziłowski [15], we are currently dealing with a temporary deterioration of the situation on the GPW caused by concerns about growing inflation and fast rising of interests rates as well as a change of asset allocations by global and local institutional investors. He also is of the opinion that the next coming waves of the Pandemic and uncertainty induced by information about potential threats associated with new virus mutations and an increase of geopolitical situations in Eastern Europe does not favour the stock market.

______________________________________________

[1] Dutch Physicist and Nobel Prize Winner for physics in 1922

[2] On January 4th , 2022, the Monetary Policy Council decided to rise interest rates by 0.5 p.p. (percentage points). As a consequence, the main interest rate on which the credit instalment depends exceeded the level of 2% for the first time since 2014. Recently the interest rate was increased by 0.5 p.p. to 2.25% in accordance with market expectations. This is the fourth rise. From October 2021, the MPC increased interest rates by 2.2 p.p. At the same time the rates of WIBOR 6M went up to over 2.6 p.p. and they may be even higher. The WIBOR 6M rate shall grow in accordance with Forward Rate Agreements by 1.7 p.p. within the year in terms of the current 2.87% (see https://businessinsider.com.pl/twoje-pieniadze/stopy-procentowe-najwyzsze-od-siedmiu-lat-rpp-podjela-decyzje/4rvk33r).

[3] Investment predictions for 2022 – TMS report, p. 3; G. Siemionczyk, Inflacyjny wstrząs dopiero przed nami, Rzeczpospolita 03.01.2022; https://businessinsider.com.pl/gospodarka/makroekonomia/to-czeka-gospodarke-w-2022-r-ochlodzenie-koniunktury-wystrzal-inflacji-szybki-wzrost/805bbhg.

[4] Some economists are of the opinion that the inflation shield which among other things includes temporarily reduced taxes from fuels and compensation for households will be maintained longer than to the first half of 2022. This would lead to a decrease in inflation within the coming quoters at the costs of higher inflation in 2023.

[5] In the half of 2021 the Prime Minister announced an excellent budget situation as the revenues were much higher than planned. This resulted from record inflation.

[6] The former finance minister and the present chairman of the bank Pekao S.A. Mr. Leszek Skiba draw attention to the fact that the inflation lower than 1 pp. reduces by about 1 % revenues from VAT. Assuming that the revenues from VAT are at the level of 200 billion PLN then it would be possible to receive 6 billion PLN from VAT only. Along with other revenues it may be predicted that proceeds to the budget of the state will amount to between 12 and 15 billion PLN annually.

[7] Interestingly, research undertaken by the NBP shows that for exporters the rate of exchange is not the most important element of the assessment of the profitability of the expert endeavours (see https://businessinsider.com.pl/finanse/wpadka-nbp-na-twitterze-zdezorientowala-inwestorow-chodzilo-o-cel-manipulacji-kursem/myewhnz)

[8] The official website of the NBP boasted that the manipulations with exchange rate of PLN was undertaken to increase the profit of NBP. A sharp weakening of the Polish currency at the end of December 2020 led to speculation about possible interventions from the NBP. The NBP confirmed this and announced that the strengthening of PLN should be prevented, however investors speculated that the real purpose was to raise the NBP profit that should be paid to the budget of the state. A lower exchange rate of the PLN is a greater value to foreign exchange reserves and consequently a greater profit for the NBP to then be paid to the state budget (see https://businessinsider.com.pl/finanse/wpadka-nbp-na-twitterze-zdezorientowala-inwestorow-chodzilo-o-cel-manipulacji-kursem/myewhnz)

[9] Portal BusinessInsider.com.pl states that the first professional group that was influenced by adverse effects of the reform were school teachers who at the beginning of 2022 received lower salaries from their employers https://biznes.radiozet.pl/News/Polski-Lad-obniza-pensje.

[10] Bank PKO BP.

[11] Credit Agricole Bank Polska.

[12] Bank Millennium.

[13] The attractiveness of investing on the stock market decreases by growing interest rates See K. Kucharczyk, Na parkietach może być dość niespokojnie, Rzeczpospolita 22.12.2021.

[14] DM BOŚ.

[15] Managing director in the department of capital funding market of Ipopemy Securities.